3 Aug. 2023

Carbon credits are a buzzword that is being discussed more and more.

As sustainability and environmental responsibility are coming up in conversations amongst our peers, investors, and clients, we figured we should write a brief summary of what it all means.

ESG stands for Environmental, Social, and Governance. Companies, organizations, and investors are increasingly applying ESG concepts into their business models in order to participate in sustainability efforts.

Investors are increasingly applying these non-financial factors (ESG principles) as part of their analysis process to identify material risks and growth opportunities. ESG metrics are not commonly part of mandatory financial reporting, though companies are increasingly making disclosures in their annual report or in a standalone sustainability report, says CFA Institute.

One of the biggest ESG investment trends, as it relates to the environment and sustainability, is climate change–and specifically carbon emissions.

This is where carbon credits come into play.

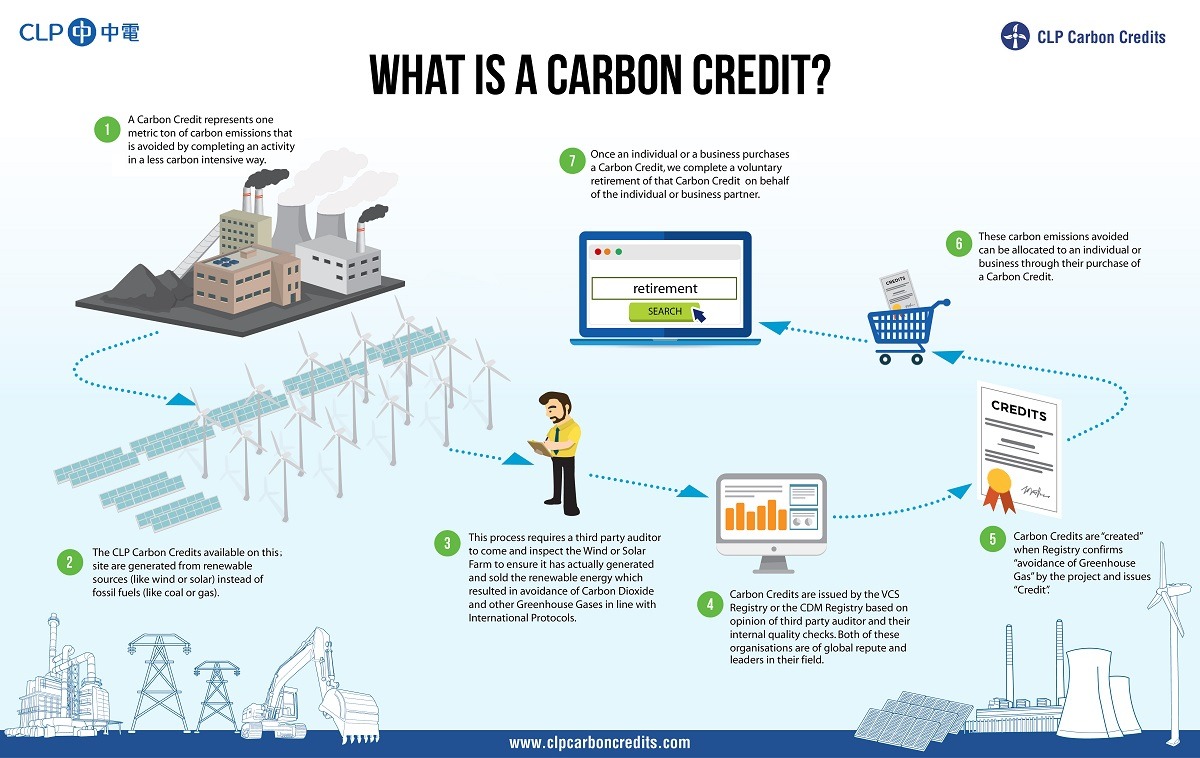

Carbon credits are an internationally recognized way for organizations to manage and make up for their carbon emissions.

A carbon credit is a “reduction in greenhouse gas emissions to compensate for emissions made somewhere else. Credits are traceable, tradable and finite: When they are purchased, they are retired forever” (Conservation)

Carbon credits are measurable, verifiable emission reductions from certified climate action projects. These carbon credits fund projects that remove, reduce, or avoid greenhouse gas (GHG) emissions. Carbon credits protect forests, support local communities, and maintain critical biodiversity–empowering communities and reducing the reliance on fossil fuels.

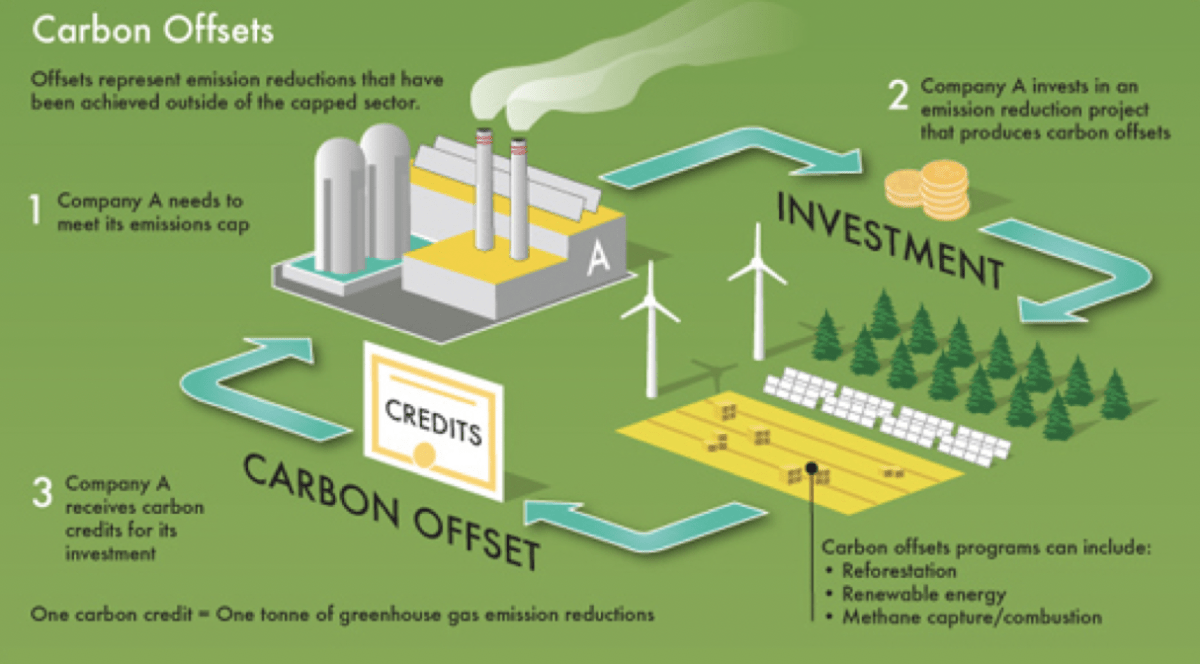

A carbon offset is a project implemented specifically to reduce the level of greenhouse gasses in the atmosphere. Offsets are so named because they counteract or offset the purchaser’s GHG emissions. (Meet Green)

Climate Action Projects must comply with a rigorous set of criteria to get verified by third-party agencies and a review by a panel of experts at a leading carbon offset standard.

For example, companies should ensure the “projects they invest in are registered with a third-party internationally-recognized verification standard, such as the Gold Standard, Verra’s Verified Carbon Standard (VCS), Social Carbon and Climate, Community and Biodiversity Standards (CCBS), or standards verified by the UNFCCC.” (Southpole)

For transparency, carbon credits are assigned serial numbers and are issued, transferred, and permanently retired in publicly accessible emission registries. (Southpole)

There are 3 types of Climate Projects:

Ones that avoid greenhouse gas emissions, for example replacing fossil fuel-derived energy with energy from renewable sources.

Ones that remove emissions from the atmosphere, for example, planting more trees.

Ones that capture and destroy emissions, for example capturing methane from wastewater.

Carbon credit prices vary depending on the size and location of a project, the types of technology used and their affordability, carbon regulations, and simple supply and demand.

So why are carbon credits important?

“As the 26th UN Climate Change Conference wraps up, ESG is becoming an increasing driver in how companies operate, leading them to buy credits to offset their current carbon emissions as they target sustainable reduction of greenhouse gases” (KITCO)

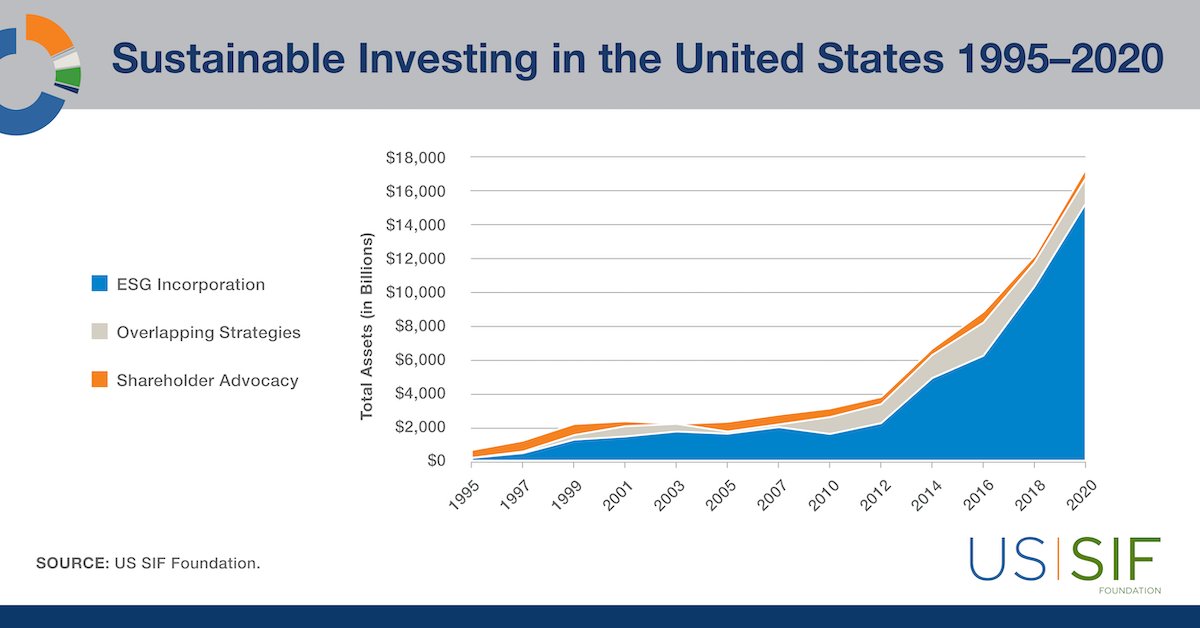

ESG issues were first mentioned in the 2006 United Nation’s Principles for Responsible Investment (PRI) report. “ESG criteria was, for the first time, required to be incorporated in the financial evaluations of companies” in order to further develop sustainable investments. (Forbes)

Source: US SIF

The emphasis on ESG is growing more and more as major institutional investors are demanding and expecting the companies they hold to commit strongly to ESG criteria.

Carbon Credits play a critical role in achieving sustainable, global climate goals. They catalyze faster climate action, attract funding to sustainable projects, develop solutions that dramatically reduce emissions, and most of all – allow companies to actually take steps and do something to reach net zero.

Carbon Credits are a new way to offset carbon emissions to mitigate the effects of climate change.

Still, it’s crucial to remember that buying carbon credits shouldn’t be the limit of any business’s climate action. Every company should be proactive indirectly minimizing carbon emissions from their business.

To learn more about other ways to reduce your carbon footprint such as Climate Intelligence, stay tuned for our next blog on our Carbon Credits series, where you can learn more about how carbon credits can help your business.